“Bitcoin” is a word with many meanings – it refers to a communication protocol, a payment system, and individual units of its currency. In the minds of many, though they might not state it directly, it also refers to an ideal, a vision of money which is free from government control, decentralised, unstoppable, with the power to remove the grip of central banks, bring prosperity to the marginalised, and even to end war. Those who revere and love Bitcoin do so with good reason, as this technology is so revelatory that many economists would have called it impossible just a few years ago. We might even call it a miracle.

When an idea lights up a new path so clearly, it’s only natural that some consider it holy, and some even do use religious language. Max Keiser referred to Bitcoin as the “Cyberchrist”, many have referred to advocate Roger Ver as “Bitcoin Jesus”, and quoted from “The Book of Satoshi”, treating the information age Prophet’s words as something that demand strict, monastic adherence.

Holy things are not beyond question. In fact, to be in the presence of a great Teacher and refraining from asking the hardest questions is to show disrespect for your Tuition. Everything that is truly pure will embrace critique, because every true Teacher delights in your most thorough understanding.

Bitcoin is many things – a phenomenon, an economic impossibility, a miracle, and its supporters tell us that it will save the world, change the world, disrupt it. Bitcoin is the vision of a better future, but here on Earth, it’s something a little different. Bitcoin Core is an open-source software project, developed and run by fallible, imperfect human beings, and while we gaze at celestial goals, we must not ignore our very terrestrial problems.

Don’t Panic

To get a clear picture of Bitcoin’s path, we have to look at the numerous factors in its favour. It has the first mover advantage, the biggest market cap in the space by a large margin, the biggest network effect, the most merchant acceptance, the most users, the most ancillary services such as debit cards, the highest visibility, the greatest number of staunch advocates, and the biggest brand. These factors also mean that it attracts the best developers.

All of these things show that Bitcoin isn’t going to be displaced in a hurry. It’s not easy or quick to take down a big network effect, so even if you see this case as accurate, selling out of terror still isn’t likely to be the best course of action. So whatever you do, don’t panic.

Price isn’t a good measure of failure or success

Many people look at Bitcoin when it crashes, and say “Ha! It’s a failure!” Likewise, many look at Bitcoin when it surges and say “Aha! It’s a winner!” People on both sides are using a short-term indicator to extrapolate long-term results, and so both can easily be misled.

Likewise, Bitcoin’s previous price action is some indication of its future action, but it is no guarantee.

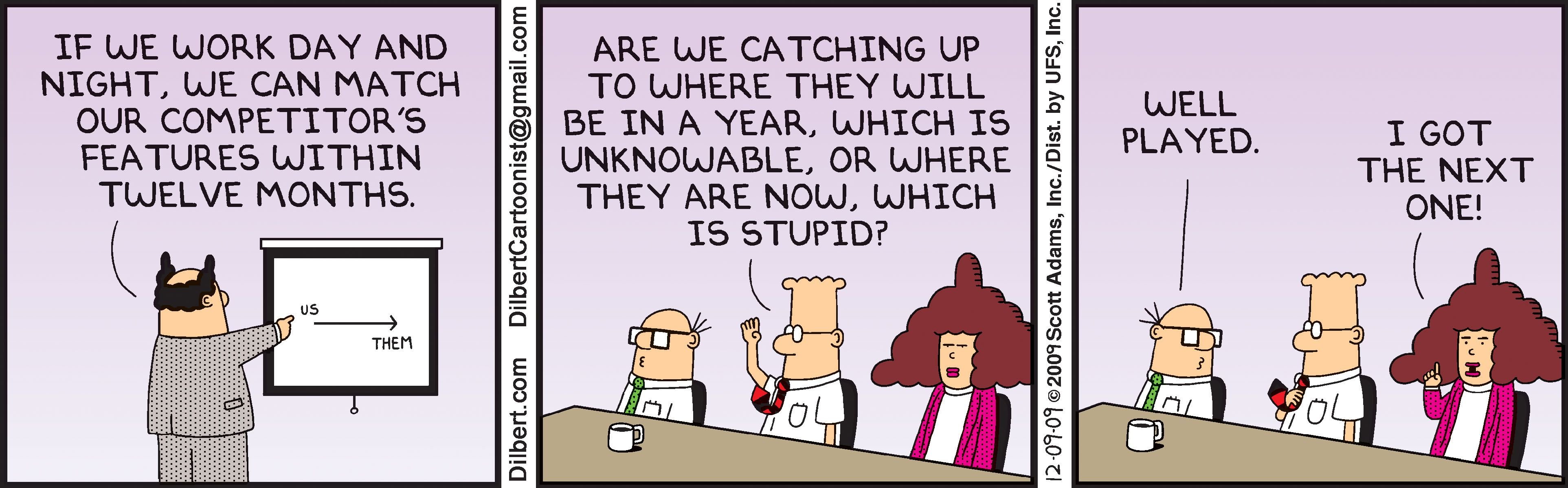

Marginal improvements and network effect –

To displace a technology that has a leading network effect, it’s not enough to make something marginally better. People’s familiarity with current tech, and the investment of money and time to acquire and learn about something new, and the stubbornness of their friends, mean that whatever is widely used today is likely to continue to be widely used. So when a new technology is proposed, it has to be good enough that it overcomes this inertia. The curious thing is, it’s not always clear what change is sufficient to push a gadget over the threshold.

A Betamax video cassette player – Wikimedia Commons

Betamax vs VHS

Betamax had a clear lead on the market over VHS by more than a year, and its network effect was measured by the amount of VCRs in people’s homes and the videos in stores. VHS was the newbie and therefore, the underdog. VHS had what people wanted – 120 minutes of play time, enough to play most movies, and its VCRs were hundreds of dollars cheaper.

In this case, on the surface it might seem that VHS had a marginal improvement – just a tinkering of the numbers. But it pushed the tape over the threshold, allowing people to watch movies without changing cassettes, with an entertainment system that costs $100s less. Read more here: Why VHS was better than Betamax

Here, Bitcoin Cash advocates can make the case that their block size increase might be that change which pushes it over the threshold, and they have a point, but there is a little more to it. The other lesson from this case is also that Beta had the advantage, but Sony made a long list of errors, denying their users features that they wanted, or providing an inconsistent user experience, and conversely, VHS established a history of innovating and giving users those features, and in the long term, that enabled them to maintain market dominance. Read more here: The rise and fall of Beta

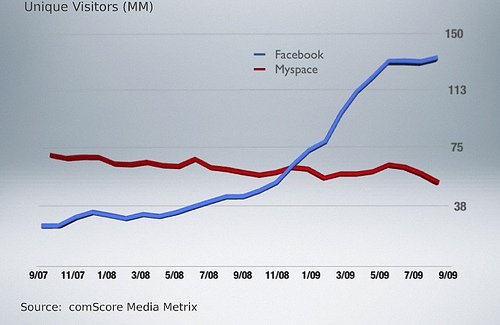

The Face vs The Space

Myspace displaced Friendster, building a network of 75.9 million people, and was bought by News Corporation in 2005 for $580 million. With such a strong lead on the competition and an established network effect, it would be reasonable to assume that it would continue that way for a while. Read more: Myspace: The Rise, Fall and Rise Again

Facebook took over for several reasons, and almost all of them revolve around user experience – the simple, clean user interface with a wide appeal compared to Myspace’s sparkly fairy gifs and emo punk songs on autoplay; its air of respectability and exclusivity, being only for college students; its feed giving people something to get addicted to, to stay logged in; and the lack of spam on Facebook. People also preferred Facebook because Myspace was practising political censorship, passing many links on their site through a redirect and hindering Ron Paul’s 2008 campaign. Basically, Facebook had better marketing and a better user experience.

Bitcoin’s Marketing & UX

Considering Bitcoin has no official marketing budget, with all of its marketing done by volunteers or donation, another coin or money transfer service with a structured marketing budget, such as Dash might quickly gain the right type of attention. This was highlighted a couple of months ago when founder Evan Duffield commented on a Reddit post about Bitcoin donations for a Superbowl ad. “Dash can afford this,” he wrote.

Bitcoin’s user experience is still lacking – you have to copy and paste long addresses that look like errors, or bring out your phone to scan a QR code, pointing one device at another. This is like having to enter an IP address instead of a web address in the early days of the Internet. Regular people prefer something that looks like a name, something they can even remember without resorting to a pen and pad, copy & paste, or a camera. Some digital currencies such as Bitshares and Steem already have this feature, and others are working on it. In fact, even some banks are implementing this feature.

It’s not just that Bitcoin is hard for newbies to use, it’s actually getting more difficult. Fees have been fluctuating, and not knowing the difference between a Segwit transaction and a regular old Bitcoin transaction may give you the wrong expectations about transfer times and fees. Consistency of experience affirms reliability in the minds of its users, and Bitcoin is certainly lacking consistency, at least for now.

Creating a currency platform where people are engaged enough to return daily or even stay logged in all the time isn’t easy, but that’s what has happened with Steem, with many people professing to be addicted to Steemit. Dash plans to have apps and sites where affiliated vendors offer discounted wares for users – similar to how banks and credit cards attract consumers.

First mover advantage

VHS didn’t have the first mover advantage and still succeeded. In fact, not even Betamax had the first mover advantage – that honour goes to U-matic, or the Philips N1500. Beta displaced several earlier formats, and went on to be displaced itself.

Likewise, Myspace wasn’t the first social media network, neither was Friendster. The first modern social networking site with friend connections and profiles was Six Degrees, again, a system which is all but forgotten.

Being the first mover offers some advantage, but once a project has any kind of competition, it cannot rest on its laurels. Soon your favourite project is just another option in a competitive field, and Bitcoin’s decline from 90% to 35% market dominance makes that clear.

The retreating battle of use cases –

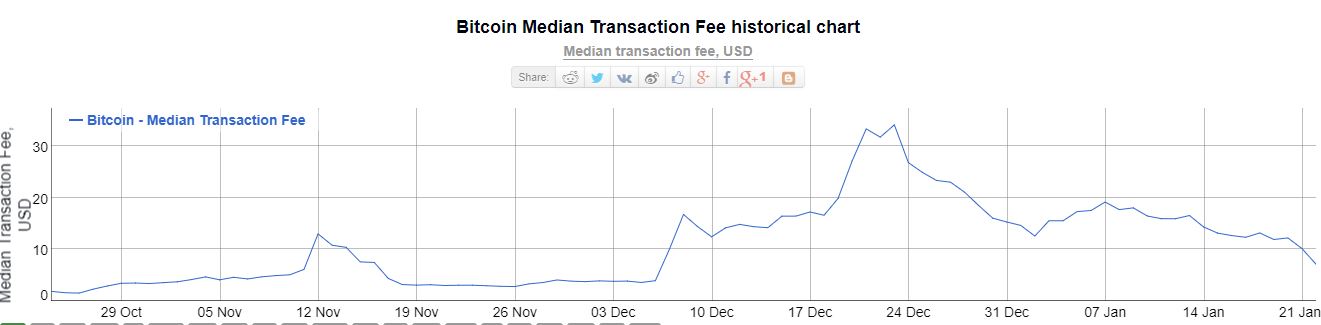

When Bitcoin was only a couple of years old, people were talking about the use cases it would make possible. It’s impossible to send $0.20 or $0.005 with Visa, but you could do it with Bitcoin. The micropayment economy could change things for content creators. Perhaps you could put up mini-paywalls on your site and charge a few cents, or less, to continue reading the article. The median transaction fee for the last three months has been between $1 and $34, clearly ruling out that use case. (Figures as of 23/1/2018)

Providing financial transactions for the unbanked was also part of the dream of Bitcoin, but if you live in the developing world earning $1 or $10 a day, and hear about a remittance service that charges you $10 to use it, you can be pretty sure that it’s not for you, and certainly not for your daily use. So that rules out that use case for most. By comparison, sending 1 to 100 Kenyan shillings ($0.01 – $1) with mobile payment system M-Pesa, is free, and sending 500 KSH (about $5), two day’s wages for an average Kenyan, costs 11 shillings ($0.10). (Source: M-Pesa rates)

We also imagined that we would use it for regular daily purchases, like buying a cup of coffee. Depending on where you live and how fancy you are, a coffee costs between $0.25 and $10. Die-hard supporters have paid for coffee in Bitcoin directly, but waiting around for a ten minute confirmation isn’t a great user experience, and the current fees are again excessive. It’s true that you can use a Visa debit card backed by Bitcoin, and it is quite convenient, but that limits the functionality in other ways – providing a choke point for governments to attack for supporting politically unpopular causes. In the famous example of using Bitcoin to support Wikileaks in its darkest hour, the Visa cards would have been blocked. Recently, Visa decided that they’d no longer work with WaveCrest, causing several brands of crypto Visa cards to stop functioning. Visa’s CEO later stated “We at Visa won’t process transactions that are cryptocurrency-based. We will only process fiat currency-based transactions.” The crypto Visa cards that still work might not for long.

Then there are medium-sized purchases or remittances in the hundreds of dollars, in which case Visa or PayPal is commonly cheaper, and certainly easier and more familiar. Large sums of money can also be sent using Bitcoin, and it is much faster than using SWIFT or a national bank transfer – so that is a clear benefit. And Bitcoin has been, at least until today, a good store of value.

However, the less use cases, the less likely BTC will continue to be a store of value. BTC has failed at micropayments and small payments, and is only marginally useful for medium and large payments, so its record of fantastic goals and forgotten failures spells trouble for its greatest ambition as digital gold.

Expert developers on sweeping duty

Bitcoin is the biggest project in the market, and so it attracts the best developers. The problem is, in a project where the developers must be risk averse, there is less and less benefit in having excellent developers. Excellent developers are innovators, and if they are put in a project where they cannot innovate, they will eventually leave, and only the mediocre devs will be left behind. This is called “the Dead Sea effect”.

In fact, we may have already seen the beginning, on January 15 2016 when Mike Hearn decided to leave the project. In Hearn’s public statement about leaving Bitcoin Core, he described all of the problems with the Bitcoin experiment, including a lead developer who never wanted the title and a core developer who didn’t and doesn’t believe the vision of Bitcoin is even possible. Hearn’s words ring truer every month.

However, I don’t want to over-emphasise this point. The Bitcoin Core team is still innovating, having developed Segwit and eventually implemented it, now allowing implementation of lightning networks.

Potential problems with Segwit

In software developer Nathan Hourt’s article, “I looked into Segwit, and here’s what I saw”, he describes the problems with censorship in the Bitcoin community, with criticisms of Segwit being removed from forums, and everyone given the impression that any detractors were outliers and shouldn’t be taken seriously. Nathan explains a potential exploit in Segwit, a “cheap and dirty” fix which would allow people to spend bitcoins without controlling the private keys. If Nathan’s analysis is accurate, it could threaten the integrity of the entire system.

Peter Rizun’s presentation about Segwit shows similar concerns.

With segregated witness implemented on August 24th 2017, and no obvious cases where such an exploit has occurred, it’s possible their concerns aren’t as grave as once suspected.

Endless forks

Bitcoin Cash, then Bitcoin Gold, Bitcoin Diamond, Platinum, Cotton, Silk, Copper, Paper and Pocket Lint. The forks seem endless, and for people outside the digital currency industry, they have no idea what it all means. With every fork, the Bitcoin brand is diluted and becomes less recognisable. It also causes user experience problems – Bitcoin Cash addresses are indistinguishable from Bitcoin addresses, and many people have lost access to their money because of that.

Lack of consensus

The forks are a symptom of an inability to find consensus in the community. The Bitcoin Core team have their ideas of what success look like, their investors Blockstream, MIT, BTCC, and so on, each have their own ideas, the miners and the supporters have yet other ideas. The only system in Bitcoin that really enables their voices to be heard, is to fork. That means it’s likely to continue to be messy.

A store of value

Bitcoin fanatics tell you that it doesn’t matter so much that Bitcoin is declining in utility; what’s important is that it’s a store of value. Originally, the thing that made it a store of value was that it was useful. People could send money around the world without being inhibited by governments or large transaction fees. Now there are many competitors which will enable those transactions, and Bitcoin’s costs are inconsistent and sometimes excessive, becoming less and less useful. Its momentum continues, but that can only last for so long.

One case is that Bitcoin is a store of value because it has brand awareness, network effect and use. USD, SWIFT and Visa all have bigger brands, network effects, and greater use, but with cryptocurrency as a competitor, all of their futures are uncertain. Likewise, for Bitcoin to be a store of value, it’s not sufficient for it to be a store of value in the past. It must be a store of value in the future. With excessive fees, a muddled identity, a lack of governance and a poor user experience in general, that future is not so certain.

Lightning networks

When lightning networks are implemented, the transaction times and fees will be dramatically improved, supporters tell us. Users will open payment channels with a few trusted hubs, allowing them to pass on their funds to the desired recipient, in an off-chain transaction that may be much more private than a conventional Bitcoin transaction. These transactions are being tested and introduced on a small scale now. Unfortunately, even in the best case scenario, user experience still seems to be an afterthought. Certain coins already have the capacity to scale to Bitcoin’s transaction level, and by the time LNs are commonplace, some altcoins will already have advantages on other fronts.

A bug or a feature

Determined supporters of Bitcoin often interpret problems with the network as points in its favour. For example, they say that 10,000 unconfirmed transactions is a positive sign, because that indicates demand for the service. High fees just go to show that people are willing to spend a lot of money to use it. The infighting and animosity in the community is a sign that decentralisation is working. And the fact that Bitcoin hasn’t gained mass adoption isn’t its failure, but the public’s unwillingness or inability to understand it.

Increased demand for a project is good. An inability to accommodate the new demand is not. The freedom to disagree in a community is good. A lack of respect and a low signal to noise ratio in discussions are not. Disruptive, empowering technology is good. An inability to present the tech in a way which welcomes potential users is not.

Conclusion: Letting go

For a project to reach mass adoption, they need to be focused on what the masses want. A project that doesn’t focus on user experience is unlikely to attain more than a niche market, and for this reason it’s likely that Bitcoin’s market dominance will continue to slip with time, perhaps even losing purchasing power in the long term.

When many of us first heard about Bitcoin and managed to wrap our heads around the concept, we saw it as a stepping stone in a path that lead to a fabled city. We said “This changes everything!” and we began to see a bright future of peace and prosperity, freedom from coercion, a world of cooperation. For these reasons, Bitcoin earns its place in the history books and in our souls, and all of its lessons, positive and negative, will undoubtedly stay with us. It surprised us, amazed us, confounded us and opened us up to a universe of possibilities, and so it is only natural that we love it. Like Bitcoin, Love means many things. It doesn’t necessarily mean believing in it to your own detriment. It doesn’t necessarily mean justifying its flaws by pretending they are benefits. However, sometimes Love does mean letting go, and for many that time has already passed.

Disclaimer

As always, I’m not here to tell you what to do with your money, I don’t know what you should do with your money. I am merely presenting my own reasoning for my decisions.